Up to $1 million in trading losses can be refunded

AvaTrade, as a top currency pair and CFD broker, has launched a new risk management tool,

AvaProtect – AVA protection plan can effectively help users reduce trading risks.

After joining the protection plan, if a transaction loss occurs within the selected time frame, you can receive up to 1 million US dollars in compensation. You only need to pay a small protection fee to hedge the risk of loss.

Risk management, peace of mind

Join the AVA Protection Plan and make your trading worry-free. During the protection period, if your position suffers a loss, you will be compensated for the loss during the protection period after the protection plan

ends. The compensation will be directly deposited into your trading account.

The AVA Protection Plan is committed to improving your satisfaction with AvaTrade and helping you achieve greater investment success. This program

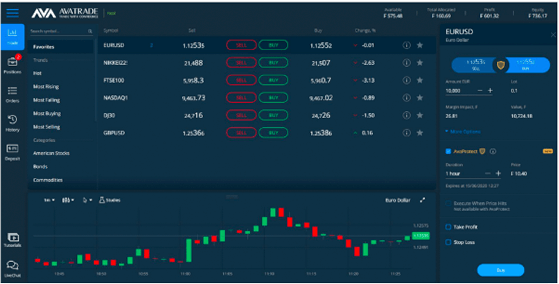

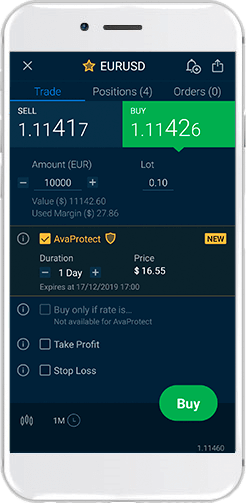

is only available on the AvaTradeGo mobile app and WebTrader. WebTrader does not require downloading. Once you have successfully registered, you can log in to your account

and start trading. The convenience it brings will be unmatched.

Join AVA protection plan in 6 easy steps

LoginAvaTradeGo or WebTrader

LoginAvaTradeGo or WebTrader

Select the product you want to trade

Select the product you want to trade

Click the AvaProtect button

Click the AvaProtect button

Select protection duration

Select protection duration

View fees and protection

expiration date

View fees and protection

expiration date

Complete and Open a position

Complete and Open a position

*Only currency pairs, gold and silver are supported

How to use the AVA Protection Plan to reduce your investment risk?

The AVA protection plan protects you from losses caused by market fluctuations during the protection period, including forced liquidation, manual liquidation, or losses from open positions when the protection expires. When the protection period ends, if all open positions have losses at the current time point, AvaTrade will return the compensation directly to your account (only the cost of purchasing the AVA protection plan at that time will be charged). During the protection period, if you manually close a position or are forced to close a position, the protection plan will end immediately, and the compensation will be returned to your account, and you can withdraw money at will.

How long does the AVA protection plan last?

Each AVA protection plan has a fixed protection period. You can manually set the protection period in hours or days. At the same time, you can manually close the position during the protection period, or set the take profit and stop loss according to your wishes, so as to manage your transactions in all aspects.

How does the AVA protection plan cost?

The rate of the AVA protection plan is calculated based on the expected volatility of the protected product during the protection period. The fee will vary depending on the size of your position and the length of the protection period. The fee will be deducted from your account balance when you purchase it.

How to reduce trading risks?

The next time you open a position, you can choose the AVA protection plan and enjoy a safe and worry-free trading experience. You can use bolder investment strategies because AvaTrade will compensate you for any losses on the position during the protection period. Your only cost is the cost of purchasing the AVA protection plan - worry-free trading, it's that simple!

AvaTrade – Make trading more confident

Multiple financial supervision

Efficient and convenient platform

Ultra-low transaction threshold

Rich trading products

Ultra-low transaction threshold

A variety of teaching resources